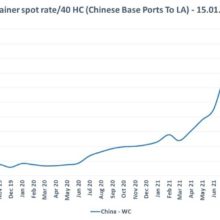

New data from Shifl shows that spot freight rates for a 40 HC container moving from Chinese base ports to Los Angeles have fallen, while spot rates to the port of New York also show a drop for the same period.

“2021 has seen historically high spot rates as the ripple effect of the COVID disruption, increased demand and blank sailings continued to wreak havoc on the supply chain. Shippers struggled to book freight as the demand was considerably higher than the carrier and port capacity” said Shabsie Levy, CEO and founder of Shifl.

However, the transit time from Chinese ports to the US West Coast remains spectacularly high, continuing where it left off in 2021. While transit times rose to 52 days in the last week of December 2021, it has come down slightly to 44 days — still a far cry from the 16 days of transit that was the norm pre-pandemic.

The lengthening of transit time is predominantly due to delays at berthing, possible delays at some of the way ports and slow steaming, a situation that has deteriorated over the last few weeks as a result of the ripple effects of the continued delays over the year. We hope to see a drop in the transit time once the demand slows down over the low season.

Transit time is lengthened by berthing

These delays are evident from the vessels that are waiting close to the shore of LA and Long Beach, and also slow steaming to San Pedro Bay. The number of ships awaiting berthing as of today stood at 92 for San Pedro Bay.

Meanwhile, transit times between Chinese ports and New York have remained steady, albeit longer than the pre-pandemic norm of 27 days. Transit time stood at 38 days in the first half of January 2022 — largely unchanged since mid-2021.

Also, as transit times to the East Coast remain lower than to the West Coast from China over the last two months, it would make sense for shippers to continue rerouting volumes from the West Coast to the East Coast if they consider transit times to be a critical metric.

“While rates have been extremely volatile, the prices have started to cool down in the runup to and following Chinese New Year as we head into the traditionally low peak season, vessels returning from LA/Long Beach and customers reporting lower demand in sales,” said Levy.